Retirement planning: It's better to be roughly right than precisely wrong

Por um escritor misterioso

Descrição

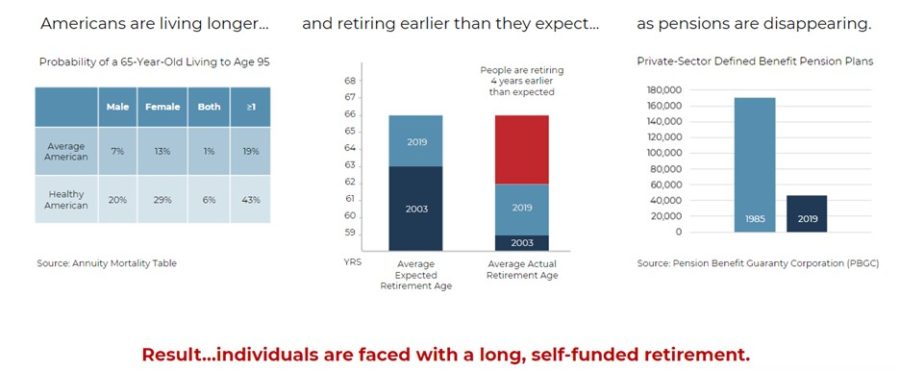

To avoid running out of money in retirement, one is advised to follow conservatism.

The 4% Rule Gets a Closer Look

Roughly Right, or Precisely Wrong?

5 Things You Definitely Shouldn't Do While Planning for Retirement

It is better to be roughly right than precisely wrong. - John

How Well Do People Perceive Their Retirement Preparedness

John Maynard Keynes Quote: “It is better to be roughly right than

Survey: Average American Feels They Need $233K A Year To Be

:max_bytes(150000):strip_icc()/rothira_final-9ddd537c67fd44ecb14dbdeba58a6ace.jpg)

Roth IRA: What It Is and How to Open One

Why saving for retirement early is important

Why Fidelity Is Wrong About Your Retirement Plan

Does the 4% rule hold up amid today's retirement planning

Why it is better to be roughly right than precisely wrong

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/origin-imgresizer.eurosport.com/2018/08/18/2400351-49905790-2560-1440.jpg)