How previous home sales might affect your capital gains taxes - Los Angeles Times

Por um escritor misterioso

Descrição

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Opinion: A Supreme Court ruling is a warning about Prop. 13 - Los Angeles Times

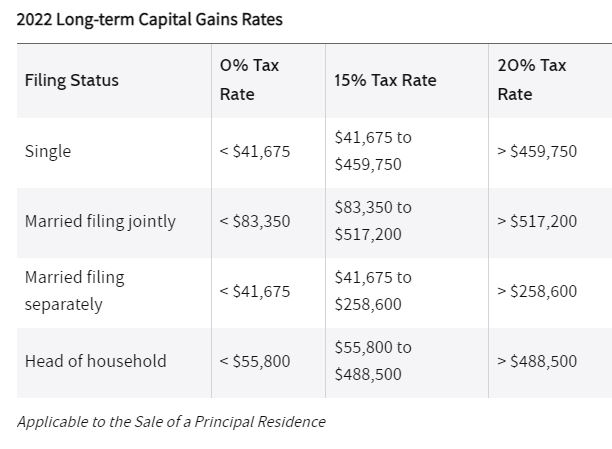

Avoiding capital gains tax on real estate: how the home sale exclusion works

Freeze in L.A. luxury market puts 'mansion tax' funds in limbo - Los Angeles Times

Stop worrying, NIMBYS — affordable housing shouldn't squash property values - Los Angeles Times

Capital Gains Tax on Real Estate and What You Need to Know

Home Sale Exclusion: Tax Savings on Capital Gain of a Principal Residence

Minimizing the Capital-Gains Tax on Home Sale

:max_bytes(150000):strip_icc()/pink-tax-5095458-final-7d40bf2d733c4a44a14ebe3ec411e3b9.png)

What Is the Pink Tax? Impact on Women, Regulation, and Laws

Freeze in L.A. luxury market puts 'mansion tax' funds in limbo - Los Angeles Times

Hiltzik: How the Supreme Court could block a wealth tax - Los Angeles Times

de

por adulto (o preço varia de acordo com o tamanho do grupo)