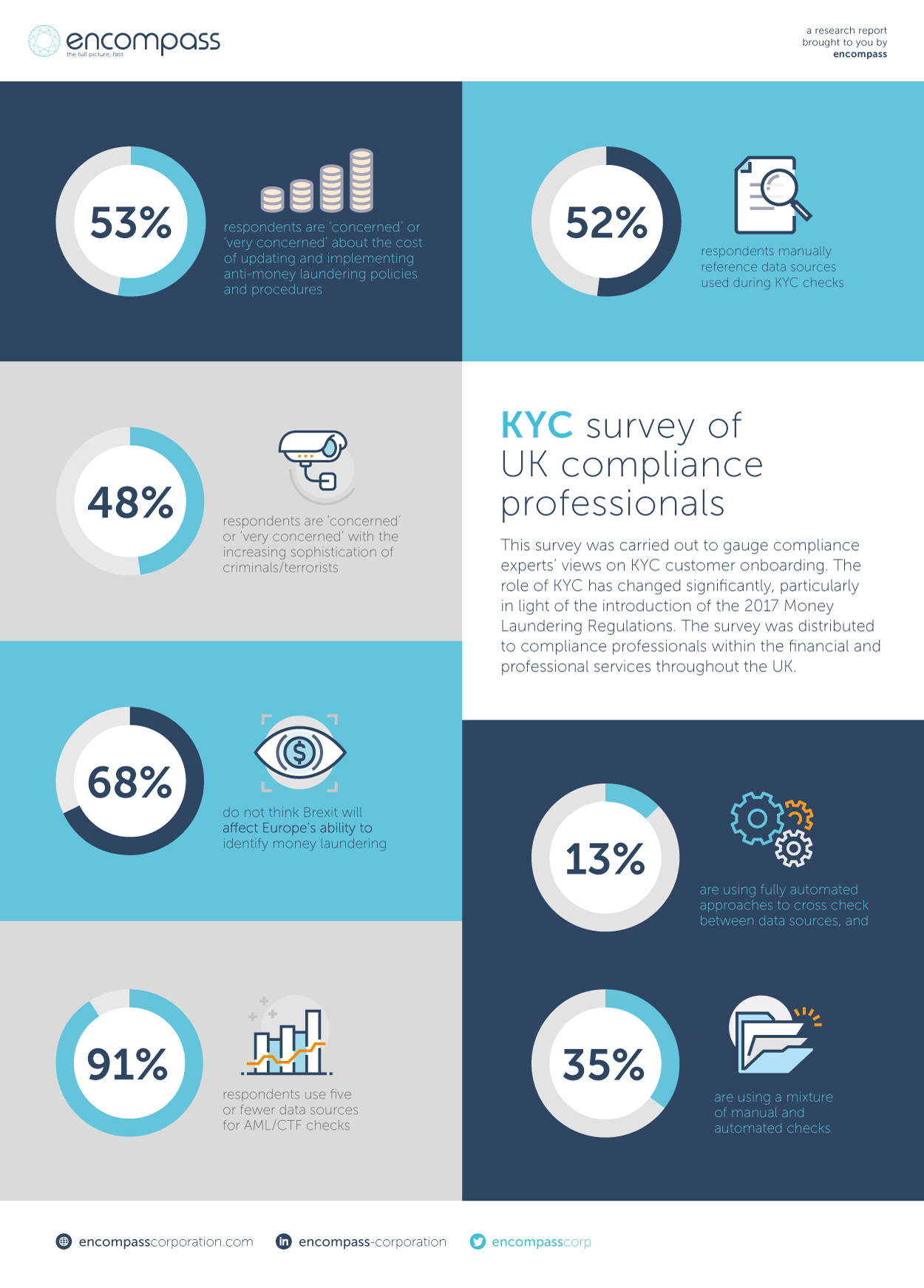

The advisory has directed taxpayers to check bank validation for

Por um escritor misterioso

Descrição

Jun 22, 2023 - The advisory has directed taxpayers to check bank validation for their GSTINs on the portal. The GSTN released the advisory on 24th April 2023, advising taxpayers to cross-check the bank account validation in GST. The taxpayer must take suitable action or wait, depending on the bank account validation status. Following are the types of bank account validation status- Success Failure Success with remark Pending for verification

Sales Tax Amnesty Programs By State - Sales Tax Institute

All about Bank Validation Status on GST Portal - Enterslice

Document

IRS Aims to Tax the Gig Economy, and Misses - Bloomberg

Retirement Cornerstone Series CP Application for an Individual Annuity

32.3.2 Letter Rulings Internal Revenue Service

The Lancet Commission on pollution and health - The Lancet

Tracking regulatory changes in the Biden era

)

Waiting For Your Income Tax Refund? CBDT Advises Taxpayers To Check Bank Account Validation Status - Learn How To Do It, Personal Finance News

de

por adulto (o preço varia de acordo com o tamanho do grupo)