Historical Social Security and FICA Tax Rates for a Family of Four

Por um escritor misterioso

Descrição

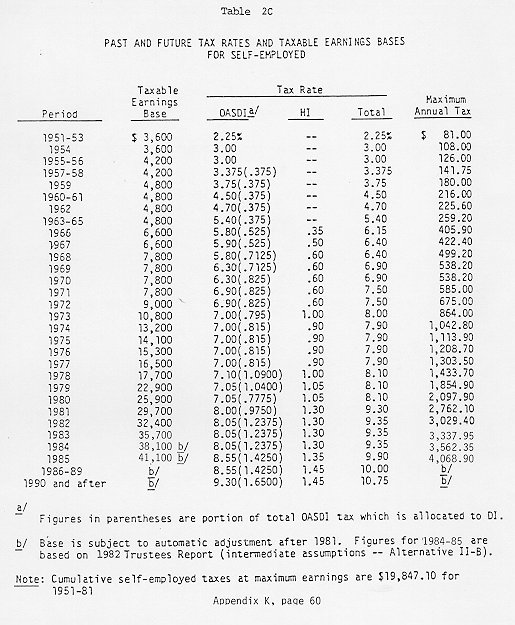

Average and marginal employee Social Security and Medicare (FICA) tax rates for two-parent families of four at the same relative positions in the income distribution from 1955 to 2015.

The ROI On Paying Social Security FICA Taxes

How 5 Big Social Security Changes in 2024 Affect You

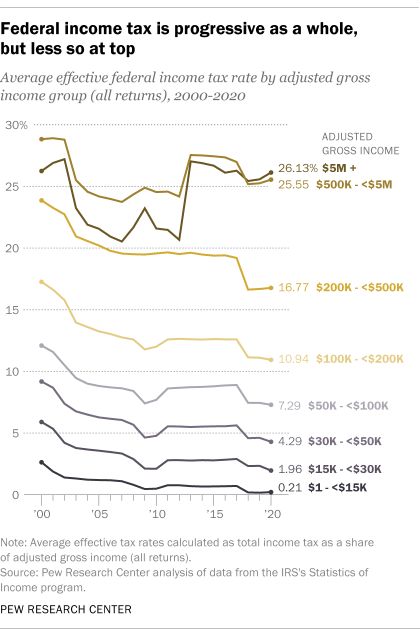

Federal Tax Income Brackets For 2023 And 2024

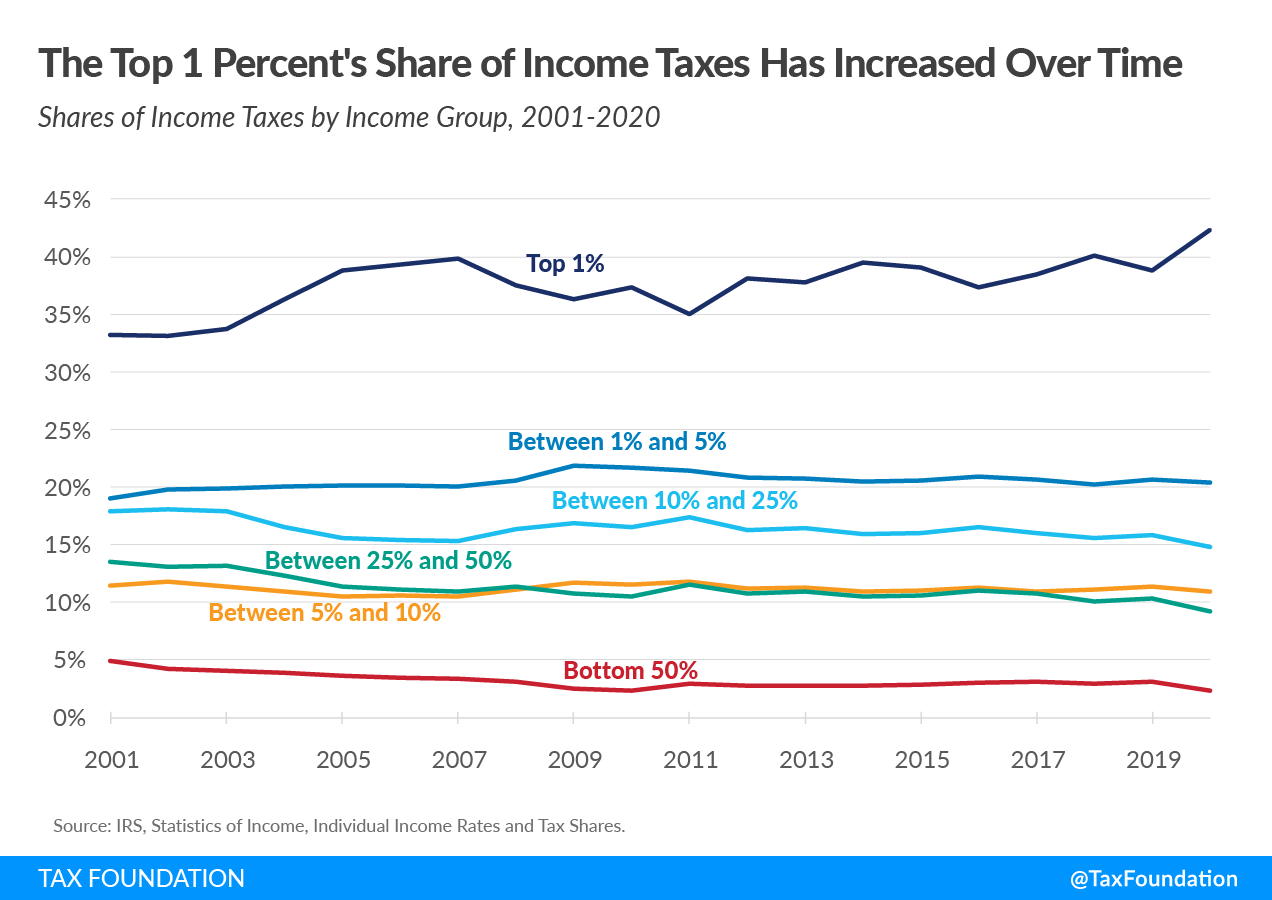

Who does and doesn't pay federal income tax in the U.S.

Historical Social Security and FICA Tax Rates for a Family of Four

Social Security History

The Distribution of Household Income, 2019

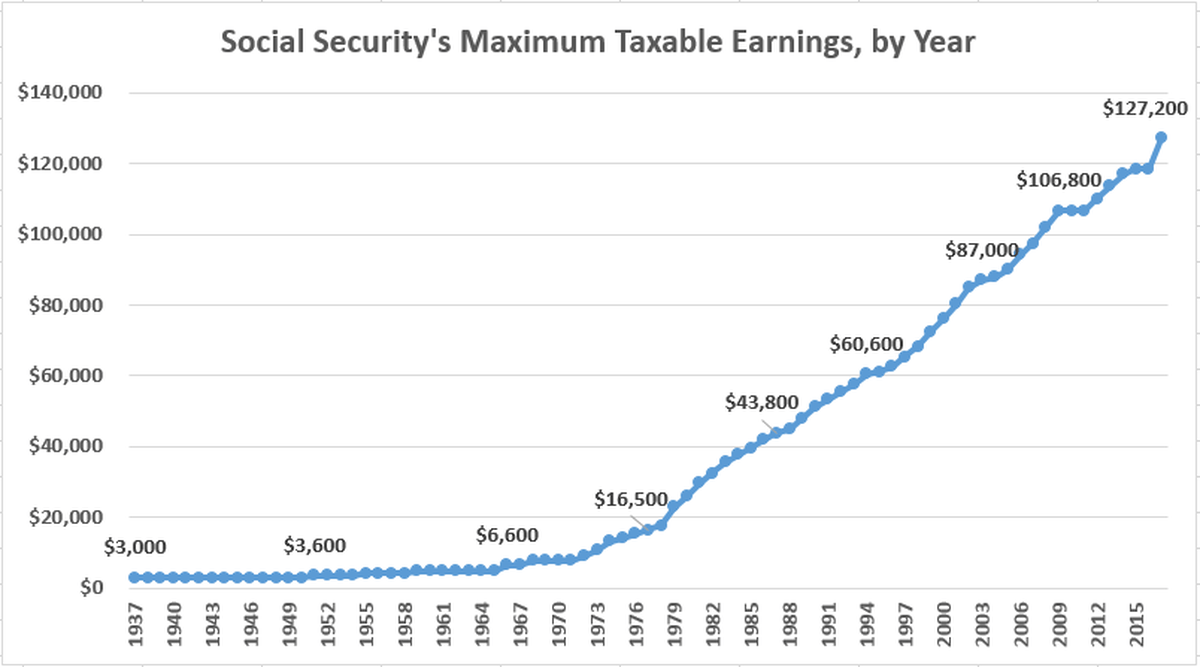

Maximum Taxable Income Amount For Social Security Tax (FICA)

Who Pays Federal Income Taxes? IRS Federal Income Tax Data, 2023

What are the Social Security trust funds, and how are they financed?

Social Security History

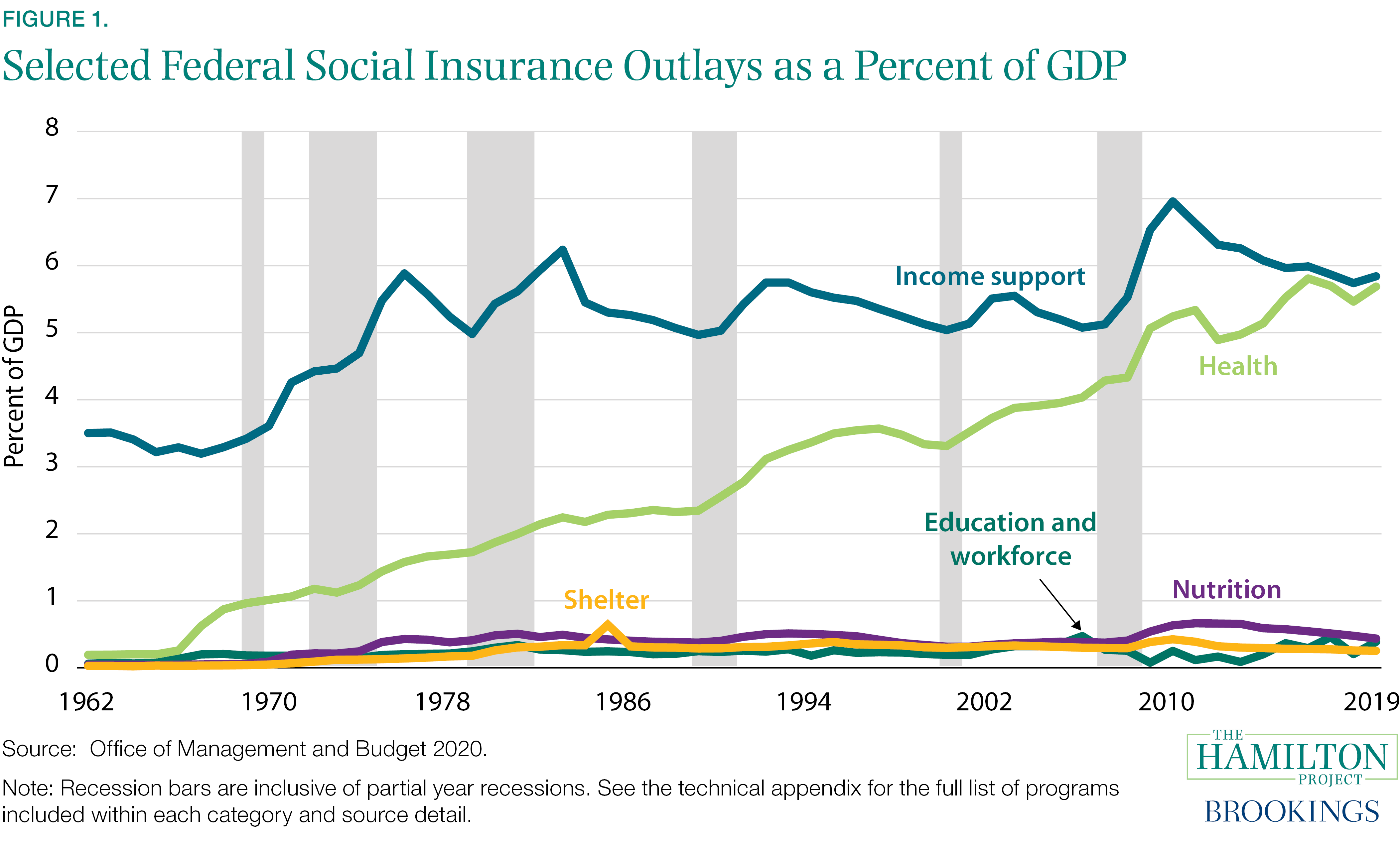

The social insurance system in the US: Policies to protect workers and families

de

por adulto (o preço varia de acordo com o tamanho do grupo)