What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax

Por um escritor misterioso

Descrição

Your company always uses to deduct a certain amount from your each pay period. Payroll taxes are the means through which the government receives this money.

FICA stands for Federal Insurance Contributions Act. FICA is a federal payroll tax which is needed to be paid

FICA stands for Federal Insurance Contributions Act. FICA is a federal payroll tax which is needed to be paid

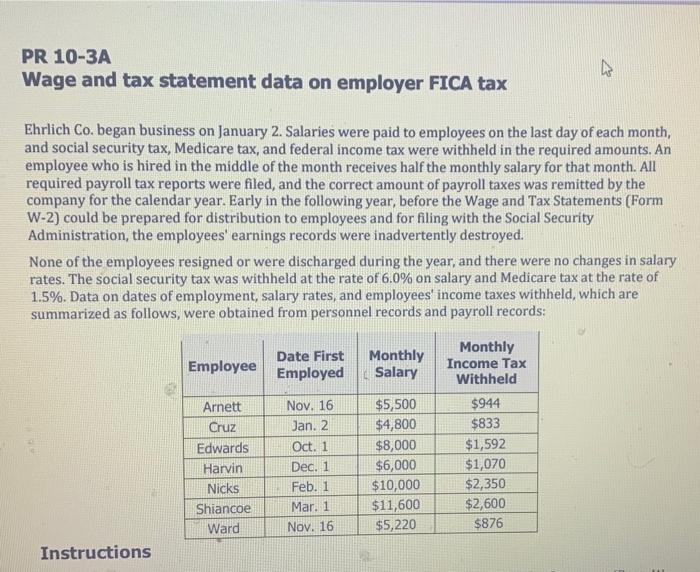

Solved PR 10-3A Wage and tax statement data on employer FICA

Solved] . 2022 CLASS (2021 tax year) Form 4137 Social Security and

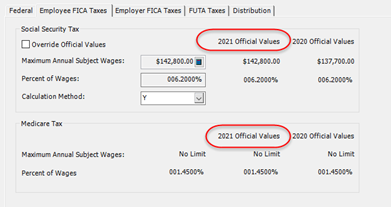

How to Proof FIT Tax Calculation

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

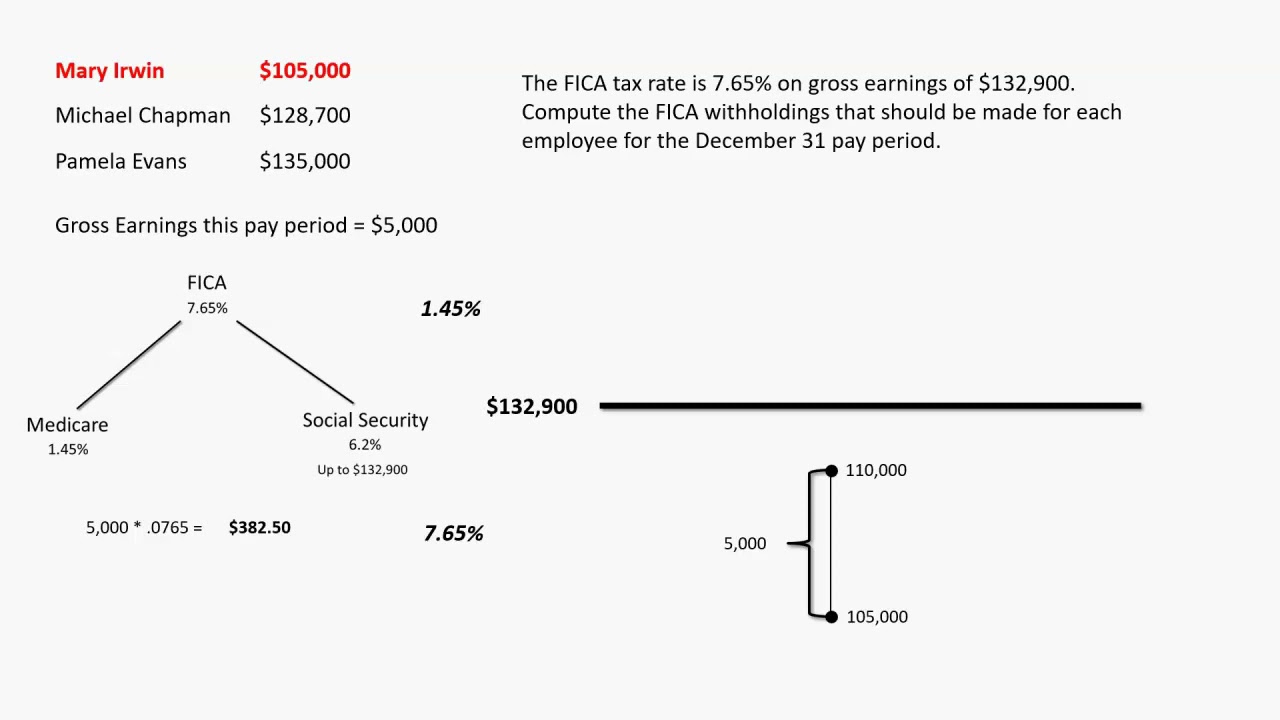

Calculating FICA Taxes

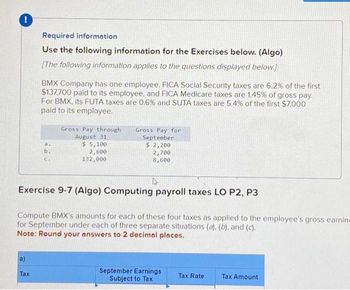

Answered: Required information Use the following…

Prior pay period paycheck stubs and selected payroll data fo

Free Tax Preparation Tygart Valley United Way

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

What is FICA Tax? - The TurboTax Blog

Social Security COLA Increase for 2023: What You Need to Know - The New York Times

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

de

por adulto (o preço varia de acordo com o tamanho do grupo)