Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

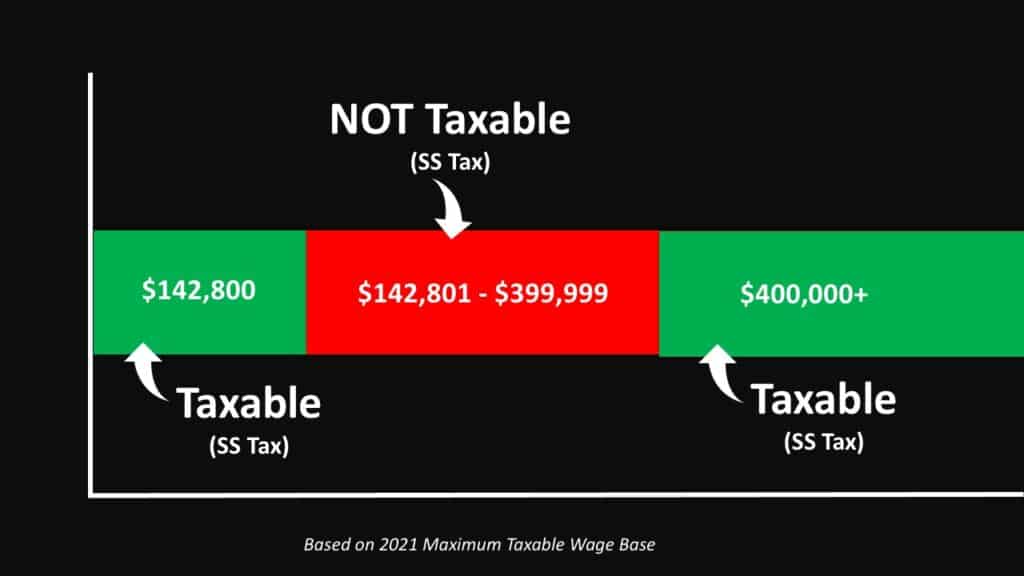

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Understanding pre vs. post-tax benefits

Employers: In 2023, the Social Security Wage Base is Going Up

How An S Corporation Reduces FICA Self-Employment Taxes

What is a payroll tax? Payroll tax definition, types, and

Understanding Your Tax Forms: The W-2

What are FICA Taxes? Social Security & Medicare Taxes Explained

The Myth of Fixing Social Security Through Raising Taxes – Social

Federal & Regular FICA Tax Table Maintenance (FEDM & FEDS)

What is FICA Tax? - The TurboTax Blog

Overview of FICA Tax- Medicare & Social Security

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

FICA explained: Social Security and Medicare tax rates to know in 2023

Employees Paychecks - FasterCapital

2024 Social Security Wage Base

de

por adulto (o preço varia de acordo com o tamanho do grupo)