Training Manual: The Basics of Financing Agriculture Module 3.3

Por um escritor misterioso

Descrição

Session Overview LEARNING OBJECTIVE To minimize risks emerging from incorrect data reporting, bankers must validate the soundness of the financial information provided to them. Therefore cross- checking the client documents is essential for making sound business decisions. This session provides an overview of key techniques to cross-checking that the banking team may find useful in handling agricultural clients. SCOPE At the end of this session, the trainee will be well versed on the following topics: Scope and need for cross-checking in the context of lending to agricultural clients, many of which are small holder farmers, MSMEs and small scale traders Instruments that are typically used for cross-referencing the client information provided Methods for evaluating equity of the client and the potential for providing collateral for the loans sanctioned TARGET Agricultural loan officers, financial analysts, trainers, and other professionals interested in agriculture financing DURATION2 hours Module 3.3 | Management Techniques I - Cross-checking 3

Please contact us at Module 3.3 | Management Techniques I - Cross-checking.

Please contact us at Module 3.3 | Management Techniques I - Cross-checking.

Training Manual: The Basics of Financing Agriculture Module 3.3

Chemical Safety Training Modules

Pathways to strengthening capabilities: A case for the adoption of climate-smart agriculture in Pakistan – APN Science Bulletin

Training Manual: The Basics of Financing Agriculture Module 3.2

The Micro Economy Today (The by Schiller, Bradley

1TB WD SN530 M.2 NVMe PCIe 2230 CH SSD Surface Laptop 3 4 GO ProX Pro7+

DA Operations Manual 2022 by roldangorgonio - Issuu

Renewable energy commercialization - Wikipedia

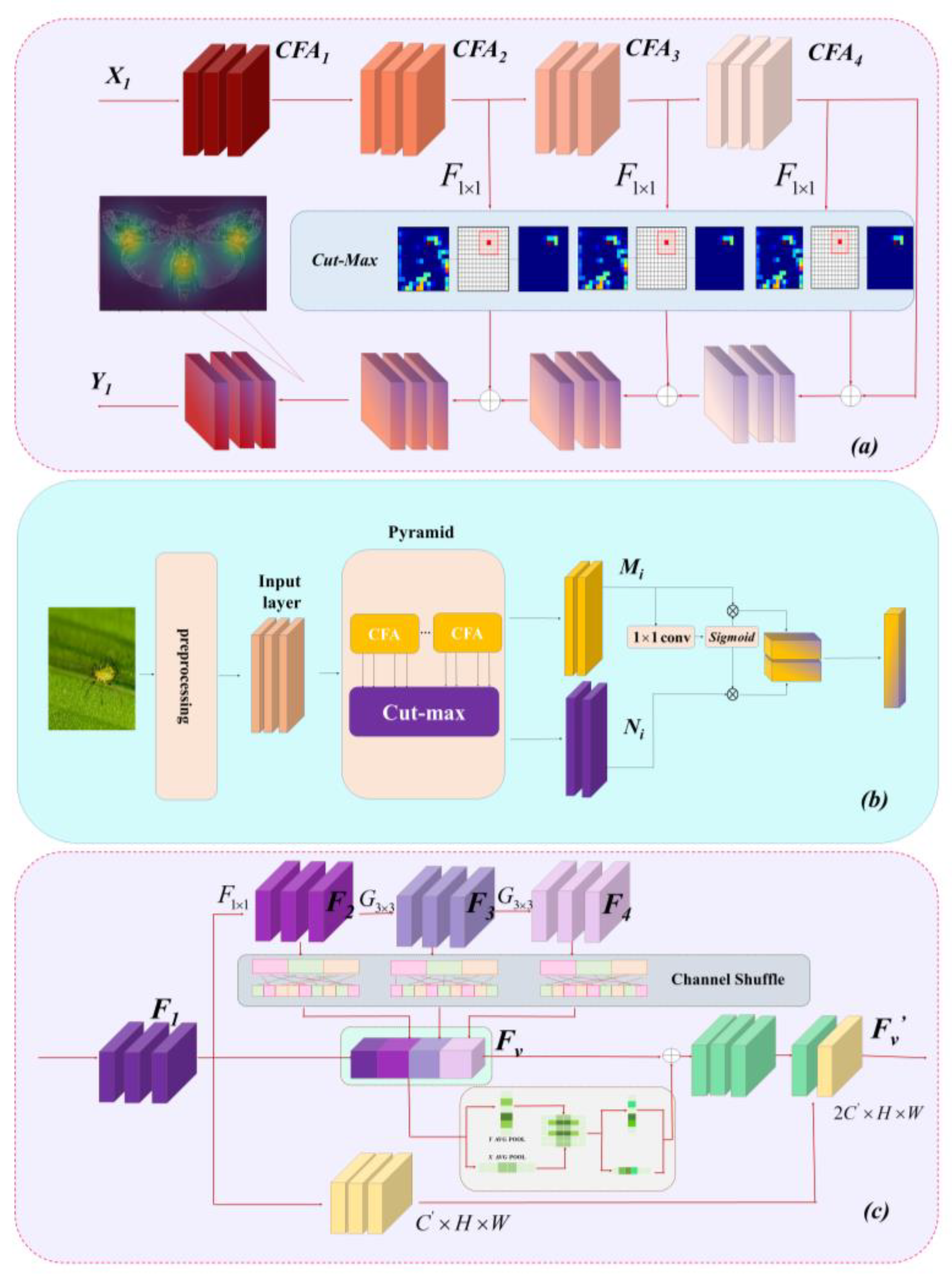

Agriculture, Free Full-Text

de

por adulto (o preço varia de acordo com o tamanho do grupo)