Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Descrição

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

Tax returns 2019: IRS again lowers underpayment penalty after outcry - CBS News

IRS Form 2210 walkthrough (Underpayment of Estimated Tax by Individuals, Estates, and Trusts)

:max_bytes(150000):strip_icc()/irs-pub-433.asp-Final-060f721b11b441b0a4b85b4ec6c6186a.jpg)

IRS Notice 433: Interest and Penalty Information

Strategies for minimizing estimated tax payments

Top 10 Tax Penalties and How to Avoid Them

IRS Tax Underpayment Penalties and How To Avoid Them

The Complexities of Calculating the Accuracy-Related Penalty

3 ways to navigate estimated tax penalty safe harbors - Don't Mess With Taxes

All About Estimated Tax Penalty Rate & How To Avoid It

How to Avoid the Underpayment Penalty for Estimated Taxes

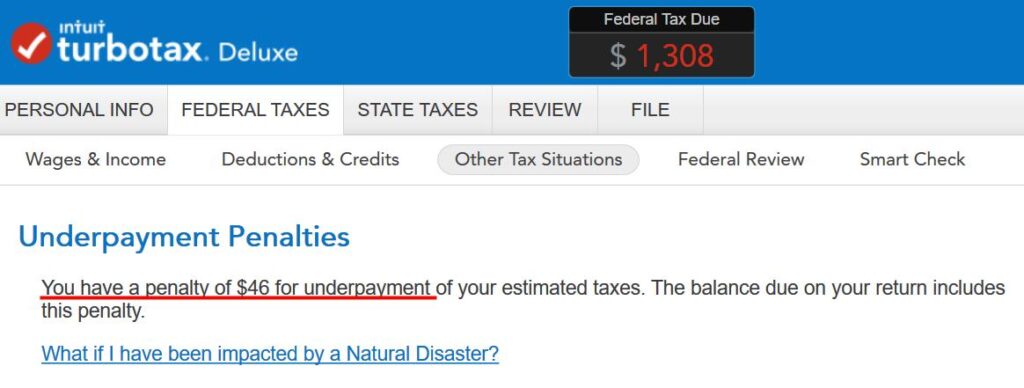

Opt Out of Underpayment Penalty in TurboTax and H&R Block

de

por adulto (o preço varia de acordo com o tamanho do grupo)