CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Por um escritor misterioso

Descrição

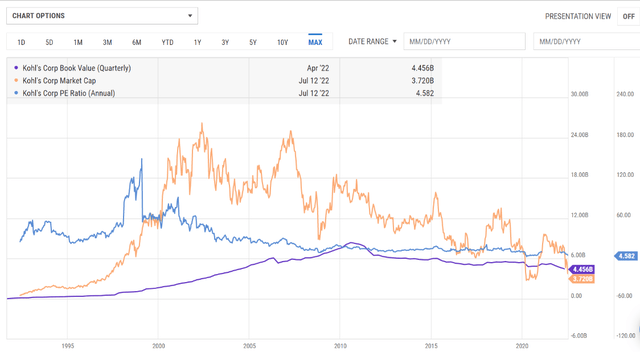

Key Takeaways: Kohl’s plans to open smaller stores and transition away from department store formatThe highest concentration of Kohl’s lease expirations occurs in 2024 impacting $815 million in CMBS debtCMBS exposure to Kohl’s totals approximately $5 billion Speculation surrounding Kohl’s and its future as a public company has been active during Q1 2022. In early-March

Dear Kohl's: A Lesson In Value Creation Or Value Destruction? (NYSE:KSS)

Shorting Real Estate, REIT Investment

Commercial Real-Estate Stress: Musk, Ackman, Chanos Predict Trouble

Brookfield Defaults on $77MM Loan for Bellis Fair Mall - The Registry

Calaméo - The Real Deal January 2015

PDF) The Impact of Technology and the Internet on Commercial Real Estate

Emerging Trends in Real Estate by Apex Real Estate Partners - Issuu

Annual Real Estate Investment Report - Greater Boston by The Real Reporter - Issuu

The Commercial Real-Estate Market's Impending Crash - JSTOR Daily

Boston - The Real Reporter

PETITION

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/i.s3.glbimg.com/v1/AUTH_bc8228b6673f488aa253bbcb03c80ec5/internal_photos/bs/2020/8/x/lnsjWPSRGBqayuteDzVQ/captura-de-tela-2020-05-14-as-11.56.42-am.png)