FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Por um escritor misterioso

Descrição

IRS Guideline: Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees What is FICA? FICA is the abbreviation of the Federal Insurance Contribution Act. The FICA tax is a United States federal payroll tax administered to both employees and employers to fund Medicare and Social Security. This means that when you…

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

What tax forms I have to submit as an OPT student who will be

OPT Student Taxes Explained

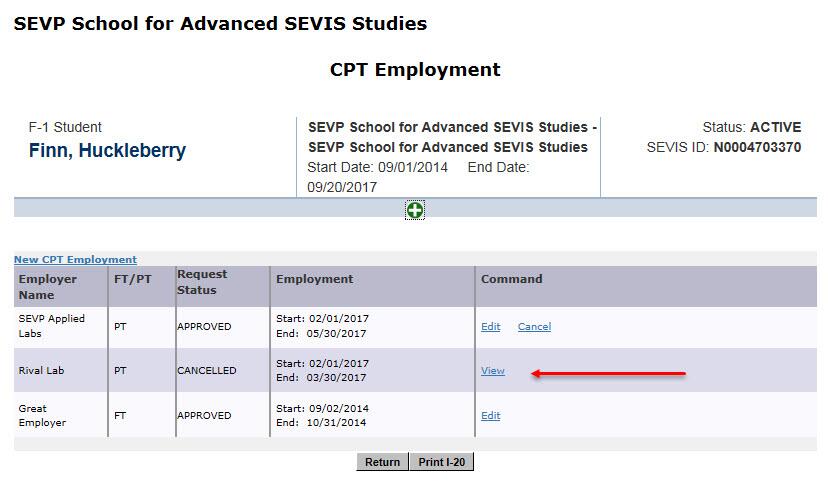

F-1 Curricular Practical Training (CPT)

Electric Vehicle Tax Credits for international students in the US

How to Earn Money on Student Visa in the US

US Tax Return & Filing Guide for International F1 Students [2021

How to File Taxes for F1, OPT, STEM & H1B Visa Holders + Non

Electric Vehicle Tax Credits for international students in the US

Income Tax International Student and Scholar Services

US Tax Return & Filing Guide for International F1 Students [2021

de

por adulto (o preço varia de acordo com o tamanho do grupo)

.jpg)