FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

Tax relief for good deeds

IRS Form 941: How to File Quarterly Tax Returns - NerdWallet

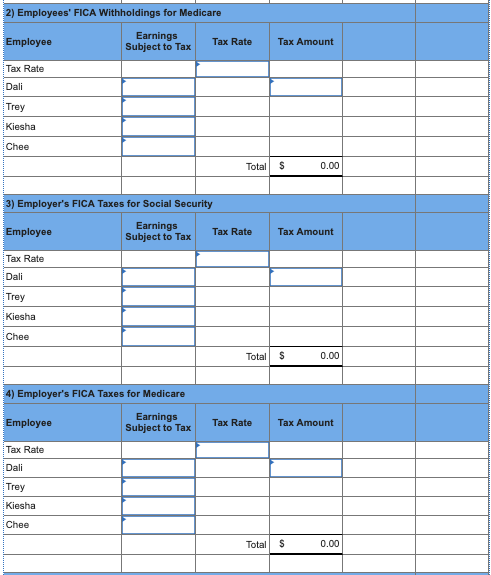

Solved Paloma Co. has four employees. FICA Social Security

How to Ask for a Raise in an Uncertain Economy - NerdWallet

What is payroll tax?

FUTA vs: FICA: Distinguishing Between Federal Payroll Taxes - FasterCapital

Tax Planning Strategies: Tips, Steps, Resources for Planning

The Complete Guide to Independent Contractor Taxes - NerdWallet

LLC vs. Sole Proprietorship: How to Choose - NerdWallet

NerdWallet App

Document

The Ultimate Small Business Guide for Tax Season 2023

de

por adulto (o preço varia de acordo com o tamanho do grupo)