2021 FICA Tax Rates

Por um escritor misterioso

Descrição

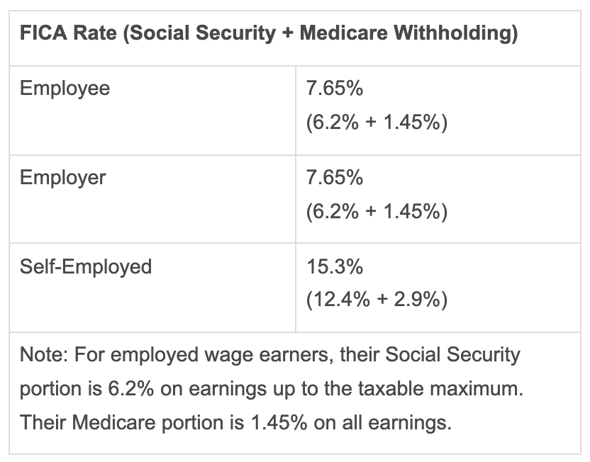

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Understanding FICA and How It Affects Your Primary Insurance Amount - FasterCapital

Withholding FICA Tax on Nonresident employees and Foreign Workers

2022 Tax Rates and Resources

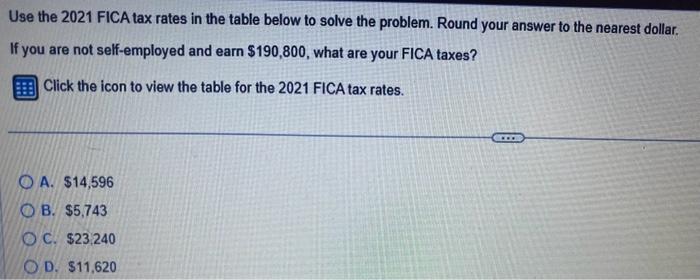

Solved Use the 2021 FICA tax rates in the table below to

Federal Insurance Contributions Act - Wikipedia

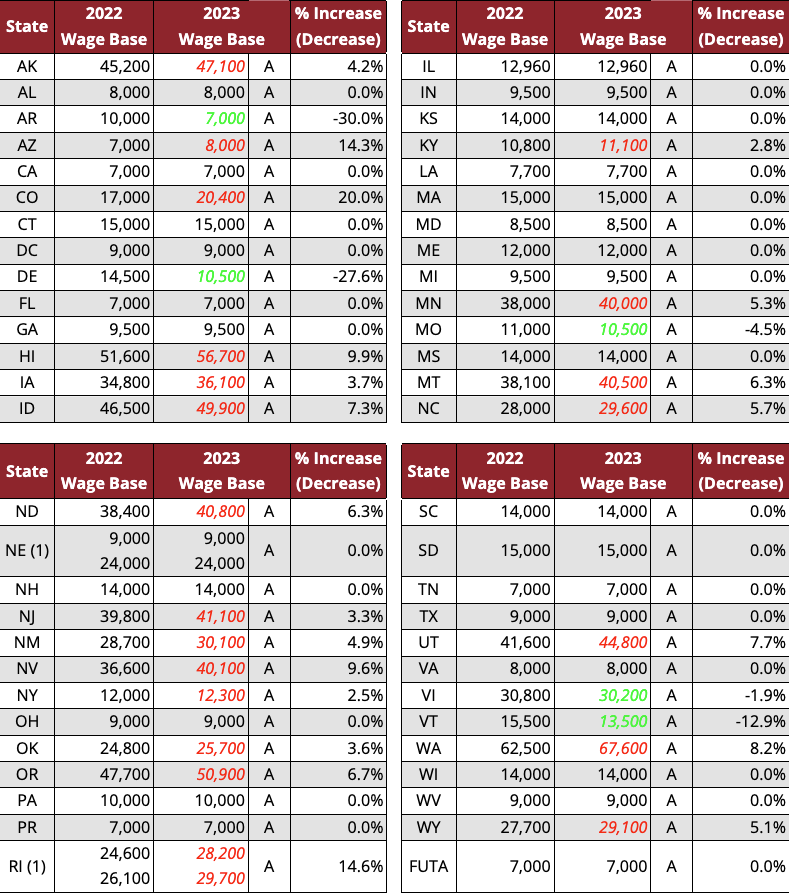

Outlook for SUI Tax Rates in 2023 and Beyond

Overview of FICA Tax- Medicare & Social Security

Uncapping the Social Security Tax – People's Policy Project

Maximize Your Paycheck: Understanding FICA Tax in 2024

2021 Wage Base Rises for Social Security Payroll Taxes

Reliance on Social Insurance Tax Revenue in Europe

IRS Announces Annual PCOR Fee Adjustment

How Tax Brackets Work [2024 Tax Brackets]

Use the 2021 FICA tax rates, shown, to answer the following question. If a taxpayer is self-employed and

de

por adulto (o preço varia de acordo com o tamanho do grupo)